म्यूचुअल फंड एक प्रकार का सामूहिक निवेश है जिसमें कई निवेशक एक साथ पैसे जमा करके विभिन्न प्रकार की प्रतिभूतियों में निवेश करते हैं। म्यूचुअल फंड को एक निवेश कंपनी द्वारा प्रबंधित किया जाता है, जिसे म्यूचुअल फंड कंपनी या एसेट मैनेजमेंट कंपनी (AMC) के रूप में भी जाना जाता है।

म्यूचुअल फंड निवेशकों को एक विस्तृत श्रृंखला के वित्तीय लक्ष्यों को प्राप्त करने में मदद कर सकते हैं, जिसमें बचत, आय अर्जित करना और धन का निर्माण करना शामिल है। म्यूचुअल फंड निवेशकों को निवेश के लिए आवश्यक वित्तीय ज्ञान और समय के बिना भी बाजार में निवेश करने की अनुमति देते हैं।

एक म्यूच्यूअल फंड के प्रबंधन के लिए एक विशेष प्रबंधक या फंड मैनेजर द्वारा प्रबंधित किया जाता है जो निवेशकों के लिए विभिन्न निवेश विकल्पों का चयन करता है और पोर्टफोलियो को प्रबंधित करता है ताकि निवेशकों को संबंधित निवेशों में मुनाफा प्राप्त हो सके।

म्यूच्यूअल फंड का लक्ष्य निवेशकों को विभिन्न वित्तीय लक्ष्यों के आधार पर निवेश करने में मदद करना है, जैसे कि विद्युत्पत्रों के लिए ज्यादा नियमित आय, लाभकारी वित्तीय विवाहित जोड़ीदारों के लिए वित्तीय स्थिरता, और आम निवेशकों के लिए वित्तीय सुरक्षा।

म्यूचुअल फंड में निवेश के फायदे और नुकसान – Pros & Cons

म्यूचुअल फंड निवेश के कई लाभ हैं, जिनमें शामिल हैं:

- विविधीकरण: म्यूचुअल फंड निवेशकों को विभिन्न प्रकार की प्रतिभूतियों में निवेश करके जोखिम को कम करने में मदद करते हैं।

- पेशेवर प्रबंधन: म्यूचुअल फंड में निवेशकों के धन को पेशेवर फंड मैनेजर द्वारा प्रबंधित किया जाता है।

- सुविधा: म्यूचुअल फंड में निवेश करना आसान और सुविधाजनक है।

म्यूचुअल फंड निवेश के कुछ नुकसान भी हैं, जिनमें शामिल हैं:

- लागत: म्यूचुअल फंडों में शुल्क शामिल होते हैं, जो रिटर्न को कम कर सकते हैं।

- जोखिम: म्यूचुअल फंडों में जोखिम शामिल होता है, और निवेशकों को अपनी जोखिम सहनशीलता के आधार पर निवेश करना चाहिए।

म्यूचुअल फंड के प्रकार – Types Of Mutual Fund

Equity Fund (इक्विटी फंड)

इक्विटी फंड (Equity Fund) एक प्रकार का म्यूच्यूअल फंड होता है जिसमें निवेशकों के पैसे शेयर बाजार में विभिन्न कंपनियों के स्टॉक्स में निवेश करने के लिए उपयोग किए जाते हैं। इन फंड्स का मुख्य उद्देश्य निवेशकों को निवेश के माध्यम से उनके पूंजीकरण को वृद्धि देना होता है और उन्हें शेयर बाजार के बढ़ते हुए मूल्यों से आय प्राप्त करने में मदद करता है।

इक्विटी फंड विभिन्न प्रकार के हो सकते हैं, जैसे कि:

1. Small Cap Mutual Fund (स्मॉल कैप म्यूच्यूअल फंड)

स्मॉल कैप म्यूच्यूल फंड एक प्रकार का म्यूच्यूअल फंड होता है जिसमें पैसे छोटी मूल्यवर्धित कंपनियों के स्टॉक्स में निवेश करने का अवसर प्रदान किया जाता है। यह फंड वित्तीय बाजार में कम वैल्यू वाली कंपनियों के स्टॉक्स में निवेश करता है, जिनकी बाजार मूल्य छोटी होती है।

स्मॉल कैप फंड में निवेशकों को छोटे आकार वाले कंपनियों के स्टॉक्स में निवेश करने का मौका मिलता है, जिनके पैसे में ज्यादा वृद्धि की संभावना होती है, लेकिन इसमें जोखिम भी बढ़ जाता है। स्मॉल कैप फंड निवेशकों को छोटी कंपनियों के सशक्त विकास के साथ ही अधिक वृद्धि की संभावना प्रदान करते हैं, लेकिन उन्हें बाजार की उच्च वोलेटिलिटी और जोखिमों का सामना करना पड़ता है।

ये फंड वित्तीय दृष्टि से उत्कृष्ट हो सकते हैं, लेकिन निवेशकों को ध्यानपूर्वक निवेश करने की आवश्यकता होती है और उन्हें उनके वित्तीय लक्ष्यों और रिस्क प्रोफाइल को ध्यान में रखना चाहिए।

2. Mid Cap Fund (मिड-कैप फंड)

मिड-कैप फंड उन स्टॉक में निवेश करते हैं जो मध्यम आकार की कंपनियों के हैं। ये फंड लार्ज-कैप फंड और स्मॉल-कैप फंड के बीच के जोखिम और रिटर्न प्रोफाइल को ऑफर करते हैं।

मिड-कैप फंड आमतौर पर इक्विटी मार्केट में निवेश करते हैं, जो स्टॉक एक्सचेंजों पर सूचीबद्ध कंपनियों के शेयरों से बना होता है। ये फंड उन कंपनियों के स्टॉक में निवेश करते हैं जिनका मार्केट कैपिटलाइज़ेशन (बाजार पूंजीकरण) लार्ज-कैप कंपनियों से छोटा होता है, लेकिन स्मॉल-कैप कंपनियों से बड़ा होता है।

मिड-कैप फंड मध्यम जोखिम वाले होते हैं, क्योंकि मध्यम आकार की कंपनियां आमतौर पर अधिक स्थिर होती हैं, लेकिन स्मॉल-कैप कंपनियों की तुलना में कम विकास की क्षमता रखती हैं। हालांकि, लंबी अवधि में, मिड-कैप फंड संतुलित रिटर्न प्रदान कर सकते हैं।

3. Large Cap Fund (लार्ज कैप फंड)

लार्ज-कैप फंड उन स्टॉक में निवेश करते हैं जो सबसे बड़ी कंपनियों के हैं। ये फंड कम जोखिम वाले होते हैं और लंबी अवधि में स्थिर रिटर्न प्रदान कर सकते हैं।

लार्ज-कैप फंड आमतौर पर इक्विटी मार्केट में निवेश करते हैं, जो स्टॉक एक्सचेंजों पर सूचीबद्ध कंपनियों के शेयरों से बना होता है। ये फंड उन कंपनियों के स्टॉक में निवेश करते हैं जिनका मार्केट कैपिटलाइज़ेशन (बाजार पूंजीकरण) भारतीय स्टॉक मार्केट में सबसे बड़ा होता है।

लार्ज-कैप फंड कम जोखिम वाले होते हैं, क्योंकि बड़ी कंपनियां आमतौर पर अधिक स्थिर होती हैं और कम उतार-चढ़ाव वाली होती हैं। हालांकि, लंबी अवधि में, लार्ज-कैप फंड उच्च रिटर्न प्रदान कर सकते हैं।

4. Multi Cap Fund (मल्टी कैप फंड)

मल्टी-कैप फंड वे फंड हैं जो विभिन्न आकार की कंपनियों के शेयरों में निवेश करते हैं। ये फंड निवेशकों को बाजार के विभिन्न क्षेत्रों में निवेश करने का अवसर प्रदान करते हैं और जोखिम को कम करने में मदद कर सकते हैं।

मल्टी-कैप फंड आमतौर पर इक्विटी मार्केट में निवेश करते हैं, जो स्टॉक एक्सचेंजों पर सूचीबद्ध कंपनियों के शेयरों से बना होता है। ये फंड विभिन्न आकार की कंपनियों के शेयरों में निवेश करते हैं, जिनमें लार्ज-कैप, मिड-कैप और स्मॉल-कैप कंपनियां शामिल हैं।

मल्टी-कैप फंड मध्यम जोखिम वाले होते हैं। वे लार्ज-कैप फंडों की तुलना में अधिक जोखिम वाले होते हैं, लेकिन स्मॉल-कैप फंडों की तुलना में कम जोखिम वाले होते हैं।

मल्टी-कैप फंड निवेशकों के लिए एक अच्छा विकल्प हैं जो जोखिम को कम करना चाहते हैं और विभिन्न क्षेत्रों में निवेश करने का अवसर चाहते हैं। हालांकि, मल्टी-कैप फंडों में निवेश करने से पहले, निवेशकों को अपने जोखिम सहनशीलता और वित्तीय लक्ष्यों की समीक्षा करनी चाहिए।

5. Index Fund (सूची म्यूच्यूल फंड)

सूची म्यूच्यूल फंड (Index Fund) एक प्रकार का म्यूच्यूल फंड होता है जिसका मुख्य उद्देश्य किसी विशेष फाइनेंशियल सूची या निफ्टी (Nifty 50) (एक स्टॉक मार्केट इंडेक्स) या सेंसेक्स की जस्ति पूरी तरह से मिमिक करना होता है। इसका मतलब है कि सूची म्यूच्यूल फंड उन स्टॉकों को खरीदता है जिनमें सूची में शामिल होने वाले स्टॉक्स शामिल होते हैं, और विपणन करता है जब वे सूची से निकलते हैं।

सूची म्यूच्यूल फंड का उद्देश्य सूची के प्रत्येक स्टॉक की उपलब्धता और मूल्य में हुई बदलती घटनाओं का पूरी तरह से अनुकरण करना होता है, जिससे निवेशकों को उस सूची के अनुसार वित्तीय परिपर्णता मिलती है।

डेट फंड (Debt Fund)

डेट फंड एक प्रकार का म्यूचुअल फंड है जो ऋण में निवेश करता है, जैसे कि सरकारी बॉन्ड, कॉरपोरेट बॉन्ड, म्यूचुअल फंड और अन्य प्रकार के प्रतिभूतियां। डेट फंड उन निवेशकों के लिए एक अच्छा विकल्प हैं जो कम जोखिम वाले निवेश की तलाश में हैं।

डेट फंडों के कई प्रकार हैं, जिनमें शामिल हैं:

- सरकारी बॉन्ड फंड: ये फंड सरकारी बॉन्ड में निवेश करते हैं, जो आमतौर पर सबसे सुरक्षित होते हैं।

- कॉरपोरेट बॉन्ड फंड: ये फंड कॉरपोरेट बॉन्ड में निवेश करते हैं, जो सरकारी बॉन्ड की तुलना में अधिक जोखिम वाले होते हैं।

- म्यूचुअल फंड फंड: ये फंड अन्य म्यूचुअल फंडों में निवेश करते हैं, जो निवेशकों को विभिन्न प्रकार के परिसंपत्तियों में विविधीकरण प्रदान करते हैं।

Hybrid Fund (हाइब्रिड म्यूचुअल फंड)

हाइब्रिड म्यूचुअल फंड एक प्रकार का म्यूचुअल फंड है जो इक्विटी और डेट दोनों में निवेश करता है। हाइब्रिड फंड उन निवेशकों के लिए एक अच्छा विकल्प हैं जो जोखिम को कम करना चाहते हैं और उच्च रिटर्न की संभावना भी चाहते हैं।

हाइब्रिड फंडों के कई प्रकार हैं, जिनमें शामिल हैं:

- बैलेंस्ड फंड: ये फंड इक्विटी और डेट में समान रूप से निवेश करते हैं।

- डेट-प्रवण फंड: ये फंड इक्विटी की तुलना में डेट में अधिक निवेश करते हैं।

- इक्विटी-प्रवण फंड: ये फंड डेट की तुलना में इक्विटी में अधिक निवेश करते हैं।

यह भी पढ़िए – एसबीआई इक्विटी हाइब्रिड फंड क्या है?

IDCW Mutual Fund (IDCW म्यूच्यूअल फंड)

IDCW Mutual Fund, जिसे IDCW म्यूच्यूअल फंड के रूप में जाना जाता है, एक प्रकार का म्यूच्यूअल फंड होता है जिसका मुख्य उद्देश्य निवेशकों को नियमित अवधि के अंदर वित्तीय साहित्य प्रदान करना है। इसका उद्देश्य निवेशकों को नियमित अंशदान के रूप में वित्तीय लाभ प्रदान करना होता है, जिससे वे अपनी निवेशों से नियमित आय प्राप्त कर सकें।

IDCW म्यूच्यूअल फंड विभिन्न प्रकार के म्यूच्यूअल फंड प्रदान करता है, जिसमें इक्विटी, डेट, हाइब्रिड और थीमैटिक फंड शामिल हैं।

Growth Mutual Funds (वृद्धि म्यूच्यूअल फंड)

Growth Mutual Fund विशेष तरीके से डिज़ाइन किए गए म्यूच्यूअल फंड होते हैं जो निवेशकों को स्टॉक मार्केट और अन्य वित्तीय निवेशों में निवेश करने के लिए प्रोत्साहित करते हैं, जिससे वे ज्यादा मुनाफा कमा सकें। इनमें निवेशकों का ध्यान अधिकतर ऐसे स्टॉकों और निवेशों पर रखा जाता है जो विकासशीलता और उनके मौजूदा मूल्य में वृद्धि की संभावना बढ़ाते हैं।

वृद्धि म्यूच्यूअल फंड्स विभिन्न उद्देश्यों के लिए उपलब्ध होते हैं, जैसे कि लंबे समयिक लक्ष्यों के लिए निवेश करना, बचत बड़ाना और आकर्षक लाभ प्राप्त करना। यह निवेशकों को बाजार के वृद्धि और नुकसान के संदेशों के आधार पर निवेश करने की स्वीकृति देते हैं ताकि उन्हें बेहतर निवेश के मौके मिलें।

वृद्धि म्यूच्यूअल फंड उच्च जोखिम वाले होते हैं, क्योंकि स्टॉक मार्केट अस्थिर हो सकता है। हालांकि, लंबी अवधि में, वृद्धि म्यूच्यूअल फंड उच्च रिटर्न प्रदान कर सकते हैं।

Dividend Mutual Funds (डिविडेंड म्यूच्यूअल फंड)

डिविडेंड म्यूच्यूअल फंड वे फंड हैं जो उन कंपनियों के शेयरों में निवेश करते हैं जो नियमित रूप से लाभांश का भुगतान करती हैं। ये फंड निवेशकों को नियमित आय प्रदान करने का एक तरीका प्रदान करते हैं।

डिविडेंड म्यूच्यूअल फंड आमतौर पर इक्विटी मार्केट में निवेश करते हैं, जो स्टॉक एक्सचेंजों पर सूचीबद्ध कंपनियों के शेयरों से बना होता है। ये फंड उन कंपनियों के शेयरों में निवेश करते हैं जो नियमित रूप से लाभांश का भुगतान करती हैं।

डिविडेंड म्यूच्यूअल फंड मध्यम जोखिम वाले होते हैं। वे लार्ज-कैप फंडों की तुलना में अधिक जोखिम वाले होते हैं, लेकिन स्मॉल-कैप फंडों की तुलना में कम जोखिम वाले होते हैं।

डिविडेंड म्यूच्यूअल फंड निवेशकों के लिए एक अच्छा विकल्प हैं जो नियमित आय प्राप्त करना चाहते हैं और कुछ जोखिम उठाने के लिए तैयार हैं। हालांकि, डिविडेंड म्यूच्यूअल फंडों में निवेश करने से पहले, निवेशकों को अपने जोखिम सहनशीलता और वित्तीय लक्ष्यों की समीक्षा करनी चाहिए।

Close Ended & Open Ended Mutual Funds (क्लोज एंडेड और ओपन एंडेड म्यूच्यूअल फंड)

क्लोज एंडेड और ओपन एंडेड म्यूच्यूअल फंड, दो विभिन्न प्रकार के म्यूच्यूअल फंड होते हैं, जिनमें निवेशकों के लिए विभिन्न वित्तीय विकल्प प्रदान किए जाते हैं।

- क्लोज एंडेड म्यूच्यूल फंड: क्लोज एंडेड म्यूच्यूल फंड एक प्रकार का म्यूच्यूल फंड होता है जिसमें निवेशकों को निवेश करने के बाद एक निश्चित समयावधि के लिए निवेश करना होता है। यानी, जब आप एक क्लोज एंडेड म्यूच्यूल फंड में निवेश करते हैं, तो आपको उस फंड को एक निश्चित समयावधि के लिए रखना होता है, जिसके बाद आप अपने निवेश को वापस कर सकते हैं या बेच सकते हैं। क्लोज एंडेड म्यूच्यूल फंड आमतौर पर IPO (Initial Public Offering) के माध्यम से बेचे जाते हैं और उनकी नवाचारिक समयावधि होती है, जैसे 3 साल या 5 साल।

- ओपन एंडेड म्यूच्यूल फंड: ओपन एंडेड म्यूच्यूल फंड वो म्यूच्यूअल फंड होते हैं जिनमें निवेशक निवेश करने और वापस करने के लिए किसी समय में मुफ्त होते हैं। इनमें निवेशक अपने निवेश को किसी भी समय खरीदने और बेचने के लिए आवश्यक नहीं होते हैं और इनमें निवेश करने का प्रक्रिया साधारणत: निवेशकों के लिए आसान होता है। ओपन एंडेड म्यूच्यूल फंड में निवेशकों के निवेश का मूल्य नेवाचारिक नेवीगेशन की आधार पर निर्धारित होता है और इनमें निवेशकों को नियमित वित्तीय सहायता प्राप्त होती है।

क्लोज एंडेड और ओपन एंडेड म्यूच्यूअल फंड्स के बीच मुख्य अंतर यह है कि क्लोज एंडेड फंड एक निश्चित समयावधि के लिए होते हैं, जबकि ओपन एंडेड फंड निवेशकों के लिए मुफ्त खरीद-दान के लिए होते हैं।

ELSS Fund (ELSS फंड)

ELSS या Equity Linked Savings Scheme फंड एक प्रकार का म्यूच्यूअल फंड है जो इक्विटी या इक्विटी से संबंधित प्रतिभूतियों में निवेश करता है। इन फंडों में निवेश करने से आयकर अधिनियम, 1961 की धारा 80C के तहत कर छूट मिलती है।

ELSS फंड्स में लॉक-इन अवधि 3 साल की होती है, जो सभी धारा 80C निवेशों में सबसे कम है। इन फंड्स में लंबी अवधि में उच्च रिटर्न की क्षमता होती है, लेकिन इनमें बाजार से जुड़ा जोखिम भी होता है।

ELSS फंड्स का मुख्य उद्देश्य निवेशकों को कर बचाने के साथ-साथ इंकम क्रिएशन भी प्रदान करना होता है, क्योंकि इनमें वित्तीय विकल्पों के रूप में निवेश करके निवेशकों को स्थिरता और वृद्धि के लक्ष्यों को पूरा करने में मदद मिलती है। ELSS फंड्स निवेशकों के लिए एक अच्छा विकल्प हो सकते हैं जो कर बचाने के साथ निवेश करना चाहते हैं और वित्तीय विकल्पों के रूप में वृद्धि की ओर बढ़ना चाहते हैं।

यह भी पढ़िए – बेस्ट ELSS फंड कैसे चुनें?

ETF & Gold ETF (ईटीएफ और गोल्ड ईटीएफ)

ETF या एक्सचेंज-ट्रेडेड फंड एक प्रकार का निवेश फंड है जो स्टॉक एक्सचेंज पर सूचीबद्ध होता है। ETF म्यूचुअल फंडों के समान होते हैं, लेकिन वे स्टॉक की तरह खरीदे और बेचे जा सकते हैं।

गोल्ड ETF एक प्रकार का ETF है जो सोने के मूल्य को ट्रैक करता है। ये ETF सोने की वायदा अनुबंधों में निवेश करते हैं, जो सोने की कीमत पर आधारित अनुबंध हैं।

ETF और गोल्ड ETF निवेश के लोकप्रिय विकल्प हैं, क्योंकि वे निवेशकों को कम लागत और लचीलापन प्रदान करते हैं।

यह भी पढ़िए – (SBI Gold ETF) एसबीआई गोल्ड ईटीएफ क्या है?

Flexi Cap Fund (फ्लेक्सी कैप फंड)

फ्लेक्सी कैप फंड एक प्रकार का म्यूचुअल फंड है जो इक्विटी और डेट दोनों में निवेश करता है। हालांकि, यह फंड मैनेजर की विवेकानुसार इक्विटी और डेट में निवेश का अनुपात बदल सकता है। इसका मतलब है कि फ्लेक्सी कैप फंड इक्विटी-प्रवण, डेट-प्रवण या किसी भी बीच के रूप में हो सकते हैं।

फ्लेक्सी कैप फंड उन निवेशकों के लिए एक अच्छा विकल्प हैं जो जोखिम को कम करना चाहते हैं और उच्च रिटर्न की संभावना भी चाहते हैं। ये फंड निवेशकों को बाजार की स्थिति के अनुसार अपने निवेश को समायोजित करने की अनुमति देते हैं।

Liquid Mutual Fund (द्रव म्यूच्यूअल फंड)

द्रव म्यूचुअल फंड (Liquid Mutual Funds) एक प्रकार का म्यूचुअल फंड है जो अल्पकालिक परिसंपत्तियों में निवेश करता है, जैसे कि ट्रेजरी बिल, कम-आवश्यकता बैंक जमा और कॉरपोरेट डिबेंचर। द्रव म्यूचुअल फंड को डेट फंड के रूप में भी जाना जाता है।

द्रव म्यूचुअल फंड उन निवेशकों के लिए एक अच्छा विकल्प हैं जो अपने पैसे को अल्पकालिक रूप से निवेश करना चाहते हैं, जैसे कि 3 से 6 महीनों के लिए। ये फंड आमतौर पर कम जोखिम वाले होते हैं और निवेशकों को अपने पैसे को जल्दी से निकालने की अनुमति देते हैं।

म्यूच्यूअल फंड निवेश के तरीके – Types Of Investment

1. Direct & Regular Mutual Fund (सीधा और नियमित म्यूच्यूअल फंड)

म्यूच्यूल फंड के निवेश के दो प्रमुख तरीके होते हैं – “सीधा” (Direct) और “नियमित” (Regular) म्यूच्यूल फंड। ये दोनों तरीके फंड में निवेश करने के तरीके को दर्शाते हैं, और निवेशकों के लिए वित्तीय ज्ञान और वित्तीय लक्ष्यों के आधार पर चयन किए जा सकते हैं।

- Direct Mutual Fund: सीधे म्यूच्यूल फंड निवेशकों को फंड हाउस या एमसीए द्वारा प्रबंधित म्यूच्यूल फंड को सीधे खरीदने का अवसर प्रदान करते हैं, बिना किसी वित्तीय संविदान के माध्यम से। इससे निवेशकों को निवेश करने के लिए अधिक रिटर्न प्राप्त होते हैं, क्योंकि इसमें किसी न्यायिक वित्तीय सलाहकार या वित्तीय दलाल की जरूरत नहीं होती, और इसके लिए कोई कॉमिशन नहीं देना पड़ता है।

- Regular Mutual Fund: नियमित म्यूच्यूल फंड निवेशकों को एक वित्तीय सलाहकार, डीलर, या डिस्ट्रीब्यूटर के माध्यम से म्यूच्यूल फंड में निवेश करने का अवसर प्रदान करते हैं। यह म्यूच्यूल फंड निवेशकों को निवेश करने के लिए एक सेवा प्रदान करते हैं, लेकिन इसके लिए निवेशकों को वित्तीय दलालों या डिस्ट्रीब्यूटरों को कॉमिशन देना पड़ता है।

2. SIP & Lump Sum (सिप और लम्प सम)

SIP और लम्प सम दो अलग-अलग तरीके हैं जिनसे आप म्यूचुअल फंड में निवेश कर सकते हैं। SIP का मतलब है व्यवस्थित निवेश योजना, और लम्प सम का मतलब है एकमुश्त निवेश।

- SIP (सिप): SIP एक ऐसी योजना है जिसमें आप एक निश्चित राशि को नियमित अंतराल पर, जैसे कि मासिक या तिमाही, निवेश करते हैं। SIP आपको बाजार की अस्थिरता से बचने में मदद करती है, क्योंकि आप हर बार एक ही राशि का निवेश करते हैं, चाहे बाजार ऊपर हो या नीचे। SIP को शुरू करना और प्रबंधित करना भी अपेक्षाकृत आसान है।

- Lump Sum (लम्प सम): लम्प सम का मतलब है एकमुश्त निवेश। लम्प सम निवेश में, आप एक ही समय में एक बड़ी राशि का निवेश करते हैं। लम्प सम निवेश एक अच्छा विकल्प हो सकता है यदि आपके पास निवेश करने के लिए एक बड़ी राशि है और आप बाजार में उतार-चढ़ाव का जोखिम लेने के लिए तैयार हैं।

3. SWP (Systematic Withdrawal Plan)

SWP (Systematic Withdrawal Plan) एक वित्तीय योजना होती है जिसमें म्यूच्यूल फंड के निवेशक नियमित अंतराल पर निवेश से पैसे निकाल सकते हैं। SWP का उद्देश्य निवेशकों को निवेश के लिए उपलब्ध निवेश पोर्टफोलियो से नियमित लिपटाव के साथ पैसे निकालने में मदद करना होता है, जिससे उनके निवेशों की मूल रकम बरकरार रहे, और उन्हें निवेशीय लक्ष्यों की ओर बढ़ते रहने में मदद मिलती है।

SWP के द्वारा, निवेशक निवेश के तहत निर्धारित रकम की नियमित वित्तीय वस्त्रा के रूप में पैसे निकाल सकते हैं, जो उनके आवश्यकताओं के साथ मेल खाते हैं। SWP के जरिए निवेशक नियमित अंतरालों पर आमतौर पर मासिक, तिमाही या वार्षिक रूप से पैसे निकाल सकते हैं, जो उनकी आवश्यकताओं के साथ मेल खाते हैं।

म्यूच्यूअल फंड रेसिओस और टर्म्स (Mutual Fund Ratios & Terms)

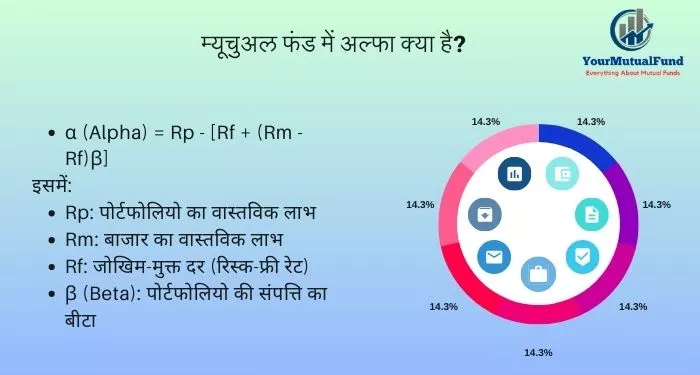

1. Alpha, Beta & Sharpe (अल्फा, बीटा और शार्प)

म्यूचुअल फंड में निवेश करने से पहले, निवेशकों को फंड के प्रदर्शन को मापने के लिए इस्तेमाल किए जाने वाले विभिन्न उपायों को समझना चाहिए। इनमें से तीन सबसे महत्वपूर्ण उपाय अल्फा, बीटा और शार्प अनुपात हैं।

- अल्फा (Alpha):अल्फा एक रिटर्न माप है जो यह बताता है कि एक फंड ने अपने बेंचमार्क की तुलना में कितना बेहतर या खराब प्रदर्शन किया है। बेंचमार्क एक संदर्भ बिंदु है, जिसे अक्सर एक इंडेक्स फंड के रूप में उपयोग किया जाता है। यदि एक फंड के पास एक सकारात्मक अल्फा है, तो इसका मतलब है कि यह अपने बेंचमार्क से बेहतर प्रदर्शन कर रहा है। यदि एक फंड के पास एक नकारात्मक अल्फा है, तो इसका मतलब है कि यह अपने बेंचमार्क से खराब प्रदर्शन कर रहा है।

- बीटा (Beta): बीटा एक रिटर्न माप है जो यह बताता है कि एक फंड बाजार की अस्थिरता के प्रति कितना संवेदनशील है। बीटा 1 से अधिक होने पर, इसका मतलब है कि फंड बाजार से अधिक जोखिम ले रहा है। बीटा 1 से कम होने पर, इसका मतलब है कि फंड बाजार से कम जोखिम ले रहा है। बीटा 1 होने पर, इसका मतलब है कि फंड बाजार के साथ समान रूप से जोखिम ले रहा है।

- शार्प अनुपात (Sharpe): शार्प अनुपात एक रिटर्न माप है जो रिटर्न और जोखिम के बीच के संबंध को मापता है। शार्प अनुपात जितना अधिक होगा, इसका मतलब है कि फंड बाजार की तुलना में अधिक रिटर्न उत्पन्न कर रहा है, जोखिम के लिए समायोजित है।

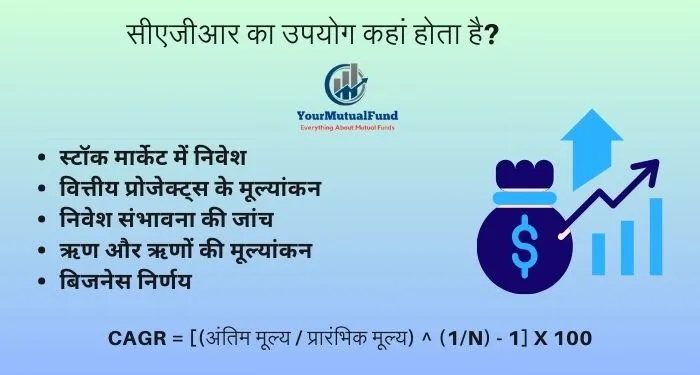

2. CAGR (चक्रवृद्धि वार्षिक वृद्धि दर)

CAGR या चक्रवृद्धि वार्षिक वृद्धि दर (Compound Annual Growth Rate) किसी निवेश के दीर्घकालिक रिटर्न को मापने के लिए उपयोग किया जाने वाला एक मीट्रिक है। यह इस धारणा पर आधारित है कि निवेश पर अर्जित रिटर्न को फिर से निवेश किया जाता है, जिससे चक्रवृद्धि ब्याज का प्रभाव पैदा होता है।

CAGR की गणना निम्न सूत्र का उपयोग करके की जाती है:

CAGR = (Ending balance / Beginning balance)^(1 / Number of years) – 1

जहां:

- Ending balance: निवेश की अंतिम अवधि की समाप्ति पर मूल्य है।

- Beginning balance: निवेश की प्रारंभिक अवधि की शुरुआत में मूल्य है।

- Number of years: निवेश की अवधि है।

म्यूच्यूअल फंड में निवेश कैसे करें? How To Invest?

म्यूचुअल फंड में निवेश करना एक आसान और किफायती तरीका है अपनी बचत को बढ़ाने के लिए। म्यूचुअल फंड बड़े निवेशकों द्वारा एकत्रित धन को छोटे-छोटे निवेशकों में बांटते हैं। यह निवेशकों को विभिन्न प्रकार के परिसंपत्तियों में निवेश करने की अनुमति देता है, जिससे जोखिम को कम करने में मदद मिलती है।

म्यूचुअल फंड में निवेश करने के लिए, निम्नलिखित चरणों का पालन करें:

- अपने निवेश लक्ष्यों और जोखिम सहनशीलता को समझें: म्यूचुअल फंड विभिन्न प्रकार के जोखिम स्तरों के होते हैं। अपने निवेश लक्ष्यों और जोखिम सहनशीलता के आधार पर, आप उन फंडों की पहचान कर सकते हैं जो आपके लिए सबसे उपयुक्त हैं।

- एक म्यूचुअल फंड कंपनी चुनें: भारत में कई म्यूचुअल फंड कंपनियां हैं। विभिन्न कंपनियों की तुलना करके, आप उस कंपनी को चुन सकते हैं जो आपके लिए सबसे अच्छी हो।

- एक फंड चुनें: म्यूचुअल फंड विभिन्न प्रकार के होते हैं, जैसे कि इक्विटी फंड, डेट फंड, और हाइब्रिड फंड। अपने निवेश लक्ष्यों और जोखिम सहनशीलता के आधार पर, आप उन फंडों की पहचान कर सकते हैं जो आपके लिए सबसे उपयुक्त हैं।

- एक खाता खोलें: म्यूचुअल फंड में निवेश करने के लिए, आपको एक खाता खोलने की आवश्यकता होती है। आप म्यूचुअल फंड कंपनी की वेबसाइट या किसी बैंक या ब्रोकरेज फर्म के माध्यम से खाता खोल सकते हैं।

- निवेश करें: एक बार जब आपके पास खाता हो जाए, तो आप किसी भी समय फंड में निवेश कर सकते हैं। आप एकमुश्त निवेश कर सकते हैं या व्यवस्थित निवेश योजना (SIP) के माध्यम से निवेश कर सकते हैं।

म्यूचुअल फंड में निवेश करते समय, निम्नलिखित बातों का ध्यान रखें:

- अपने निवेश पर नज़र रखें: अपने निवेश के प्रदर्शन की नियमित रूप से समीक्षा करें और आवश्यकतानुसार समायोजन करें।

- लंबी अवधि के लिए निवेश करें: म्यूचुअल फंड में निवेश से अधिकतम लाभ प्राप्त करने के लिए, लंबी अवधि के लिए निवेश करना महत्वपूर्ण है।

म्यूचुअल फंड में निवेश एक सुरक्षित और लाभदायक तरीका है अपनी बचत को बढ़ाने के लिए। हालांकि, यह ध्यान रखना महत्वपूर्ण है कि कोई भी निवेश जोखिम से जुड़ा होता है। म्यूचुअल फंड में निवेश करने से पहले, अपने वित्तीय सलाहकार से सलाह लेना उचित है।